Mastering The Path: What It Takes To Become A CFA Research Challenge Semi-Finalist

Introduction

Hello Everyone!!, Welcome to our ARTIFICALAB LTD Blog Post!, Today, we will be sharing about what essential skills, experience and knowledge should you have to become a winner in the path of CFA Research Challenge.

Before, we are diving into that, first of all, let's explore what is CFA Research Challenge.

What Is CFA Research Challenge ?

Actually, it is also known as the Equity Research Competition where the applicants have to conduct extensive financial research, equity research gathering, as well as giving investment recommendations in the complete report.

Indeed, it is one of the most competitive equity research competition since the applicants (mostly students) have to conduct real-word practices by assuming the role of research analysts.

So, anyway.., why I am writing about this research competition blog post ?

The answer is: the Author "Mr. Thu Ta Naing", is also a winner of Semi-Finalist in CFA Research Competition 2024, in a local competition of Thailand.

Thus, right now, I would like to share some tips and tricks on how I dedicated myself to prepare and compete to achieve up to semi-finalist position.

For now, please kindly let me introduce myself:

Currently, at the time of writing, me, the author is the Founder of this Platform and Business, called "ARTIFICALAB LTD", as well as the Master's Degree MBA Student in Bangkok University, Thailand.

Last 8 months ago, around in October 2023, I participated as a student with my peers in CFA Research Competition 2024, representing as the official team of Bangkok University.

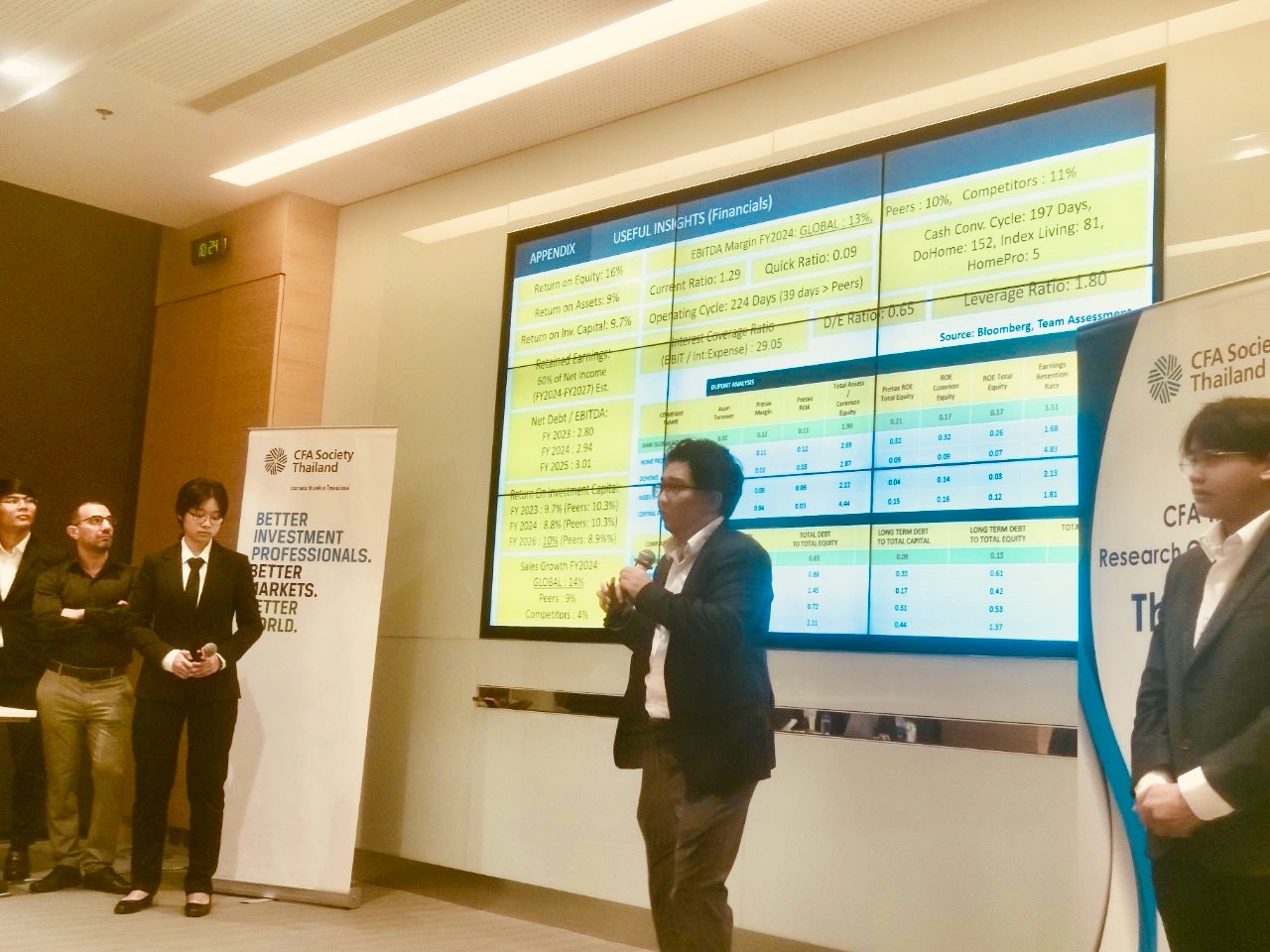

And here is our team group photo as follows:

Figure: Our team, with me (in the middle) on CFA Research Challenge 2024 Thailand, Image courtesy of my peers

"The Ability To Research The Required Key Information Of The Target Equity Company Is So Essential Such That The One Who Could Dig Into It, Results In Success Of This Competition, While The Ones Who Cannot Will Fail. During Our Times, Me And My Peers Delegate Each Tasks Into Sub-individual Parts, Which Are Then Combined Together As A Whole!

Nevertheless, The Expertise Of How-to-do Financial Analysis, Financial Projections, And Equity Valuation Techniques Are Essential!!! I'm So Glad That I Learned These Valuable Skills From The CFA Level 1 Training Course, Thanks To My Professors & Their Teachings For That!! "

— Thu Ta Naing, Semi-Finalist (CFA Research Competition 2024), Founder & CEO (ARTIFICALAB LTD)

Therefore, to be honest, it is not an easy task, and the participant have to spend nearly 3 months non-stop, dedicated time to achieve the research final report.

In our case, the equity company we have to conduct research is the "Siam Global House PCL", which is one of the top construction materials and home decoration firm, in Thailand.

Regarding the rules, tips and techniques on how to effectively write a winning CFA Research Report, we will explain u in the following section.

How To Write A Winning CFA Research Report ?

Well, there is no secret that to win against your opponents in any competition requires hard work, dedication, and perseverance than your competitors. However, in this case, regarding CFA Competition, there are definitely some rules and important tips you should follow so that you can win this competition in future like I previous did.

Therefore, I (Semi-Finalist) will share you some guidelines and tips that I can pretty guarantee that you will gain ahead of your competitors in your Upcoming Research Round!!

Now Let's deep dive into it!!

1. Gathering Resources

This is the first step, you must do, as a Financial Research Analyst.

In real world situations, you might need to gather and utilize data from the public information sources, financial platforms (like Bloomberg) and information from public interviews of respective stakeholders.

However, remember the Mosaic Theory, where you can only utilize the Material and Non-Material Public information, as well as Non-Material Private Information. To learn more about Mosaic Theory, click here.

However, in this CFA Research Competition, based on my experience, we are given a 3-month trial on Bloomberg Account, where we can extract various financial data and insights related to our target equity.

Not only that, the CFA local competition organizer also conducted an arranged organized meeting with the stakeholders of the target equity firm, and the students, where the participant students can ask various questions about the company's current status, upcoming business trends, as well as other appropriate questions, needed for the research report.

Thus, you as a participant, needs to well-know how to effectively use Bloomberg terminals, the key terms, as well as how to extract those financial insights, and ratios data, to be well-used in the report!!

(Tip: If you don't know how to you Bloomberg terminal, you better start learning as soon as possible, since it will give you an upper-hand than your opponents!)

Also, needless to say, you need to know which types of financial data you have to gather, in which I will state details as in following sections.

2. Financial Analysis

Now, you understand the importance of using Financial-ready tools like "Bloomberg" terminal. However, kindly mind that not to be fixed in one platform such that there are also other alternative terminals such as "Refinitiv Eikon", "FactSet", "S&P Capital IQ", "YCharts" etc., where you can easily analyze and extract useful financial information of your target equity.

In this section, we will talk about the importance of financial analysis in your CFA report.

Frankly speaking, financial analysis is the art of evaluating your current equity firm's financial performance, their historical results with current performance, as well as projecting the future performance with your existing current statistics and business trends.

In fact, it's an art, not an exact science, where the Financial Analyst has to thoroughly consider and understand both the business and financial aspects of the relative equity firm.

Regarding with this CFA competition, I believed that first of all, you have to gather these 3 financial statements from Bloomberg:

- Income Statement (aka Profit & Loss Statement)

- Balance Sheet (aka Statement of Financial Position)

- Cash Flow Statement

Ok now, if you haven't studied finance before, it will be a little difficult for you! So, I suggest reading my previous article as here.

Ok, let's get back on to this Financial Analysis! Since you already have Bloomberg Terminal on your hand given by the local CFA organizer, you can now extract the previous 5-7 years of Financial Statements, such as Income Statements, Balance Sheets and Cash Flow Statements.

That includes the actual financial data as well as some other Financial Ratios, that you might need to include! Starting from this stage, understanding those Financial Ratios is extremely important, since you (the participant) have to reflect those values and consider judgements on the valuation analysis.

Moreover, you might have to compare your target firm's values with peers and competitors for further analysis and conclusions for valuation.

However, regarding in this competition, I would like to state some Financial Ratios, that need to be clearly understood and included in the CFA Report.

Here are some of the Financial Ratios that should be included in your CFA Report so that it would be differentiated from your opponents and have more higher chances of being selected in the next round!!

- Firm's Solvency Analysis

- Firm's Liquidity Analysis

- Firm's Operating Cycle Analysis

- Firm's Profitability Analysis

- Dupont Analysis (3-Step or 5-Step as preferred)

1. Firm's Solvency Analysis

Regarding Solvency, you (the participant) will have to analyze the current capabilities of the firm to finance its long-term debt and obligations. That means, whether the firm can still be able to pay its debt to debtholders (mainly bondholders) as well as to its suppliers and other necessary stakeholders etc.

In fact, this is important in VALUATION result: BUY or SELL, since investors will not consider BUYING that equity stock, if there is high solvency issues in upcoming future!

Here are some of the financial ratios & values you should include in your CFA Report, based on my experience as a participant in my competition round!

- Total Amount of Debt

- Debt Ratio (Total Debt / Total Assets)

- Debt/Equity Ratio (D/E ratio)

- Net Debt/EBITDA Ratio

- Assets/Equity Ratio

- Interest Coverage Ratio

Details of these ratios and how they are reflected, I will explain later in another new post!

However, keep in mind that you (the participant) have to gather these ratios' results from Bloomberg, at least 2-3 years from current, and provide in the Appendix section of the Report!

Not only that, but you might also need to use these ratios to compare with your target equity firm and its competitors and peers!

Thereby, the readers of this Research Report will understand the actual situation of your target equity firm respective to the current Industry situation!

2. Firm's Liquidity Analysis

The next section of Financial Analysis is the Liquidity Analysis. While Solvency looks for long-term debt issues, the liquidity looks for short-term debt. This is useful for short-term investors, as well as analyzing the short-term situation of the firm's business.

Now, I will share some of the liquidity ratios you should include in your CFA research report for a good impression to readers and judges. This is as follows:

- Current Ratio

- Quick Ratio

- Cash Ratio

Also note that you might have to compare these ratios with peers, competitors and include this interpretation in your Financial Analysis section. Adding these & explaining thoroughly in the report will give you certain marks, and better impression than your opponents.

Ok, now let's head to the next ratio section!

3. Firm's Operating Cycle Analysis

Before we talk about this section, we first need to understand what really is the term "Operating Cycle". In simplest terms, Operating Cycle refers to the cash cycle of a company, where it measures the average time period it takes for a company from purchasing inventory (raw items), to selling their finished products, and finally collecting cash from customers.

In other words, the operating cycle in formula terms is

Operating Cycle = Days of Inventory on Hand (DIO) + Days of Sales Outstanding (DSO)

Regarding to compete in this CFA Competition, you (participant) need to focus on the Operating Cycle ratios if the target equity firm is the Retail Sector or Manufacturing firm.

In fact, I will state some key ratios and facts that should be included in your financial analysis section of your CFA report as follows:

- Net Sales

- Average Receivables

- Receivables Turnover

- Days in Account Receivables

- Cost of Goods Sold

- Average Inventory

- Inventory Turnover

- Days in Inventory

For now, don't worry if you don't understand the above ratios! However, please keep in mind that these ratios are essential when reflecting and analyzing about the Operating Cycle of your target firm!

4. Firm's Profitability Analysis

Ok!, Now let's continue to the next section, which is about conducting Financial Analysis on your target firm's profitability. Regarding to be effective and clear in your CFA Report, I personally suggest that the following ratios should be discussed as follows:

- Gross Profit Margin (%)

- EBITDA Margin (%)

- EBIT Margin (%)

- Pretax profit margin (%)

- Effective tax rate (%)

- Net profit margin (%)

5. DuPont Analysis

The last one is DuPont Analysis. This is the important part of your financial analysis as well as it can make or break your report! Correctly and effectively interpreting the DuPont Analysis can give you so much points from the Judges.

Indeed, there are two variations of this: 3-step DuPont or 5-step Dupont analysis.

Actually, the analysis is based on breaking down the Return on Equity (ROE) into several parts, and interpreting based on the industry benchmarks!

Anyway, I would suggest if you became the participant of this CFA Research Competition, you should better learn how to use the DuPont Tool as well!

Learn how to write effective and thorough with statistics and figures in your Financial Analysis Section!

Now, let's assume that you understand those above ratios and ready to put in your Excel format, with Tables and Figures!

However, there is one big next step you must not forget! That is, you must state in your CFA report about your Financial Analysis section of your target equity firm with statistics, ratios interpretation, industry insights and figures!

Stating financial analysis with your judgements, and brief statements are a big NO since it will decrease your impression of the Final Report by the judges!

Now, let's assume the financial ratios are ready and all the data are now already in your hand. Then, you should start writing sections by sections in the Financial Analysis Section, describing the expected within next 2-3 years of growth drivers.

Personally, I will write and analyze about the situations as follows:

- Are the Products Channels or Categories of your target firm exhibits expected positive, neutral or negative outlook from the growth drivers?

- Is the Revenue cyclical, or non-cyclical? If cyclical, how you as the Financial Analyst expects the trends of Revenue growth in the next 3-5 years?

- Currently, consider the impact of Global Supply Shocks and state how that impacts on your target firm. Prominent examples include Ukraine-Russian War, Covid-19 Pandemic, and US Biden-Trump Elections. You as a financial analyst needs to find out probable impacts on your firm's financials due to external shocks and impacts!

- Not only that, but you also need to state and analyze about the EBITDA margin as well! Analyze in detail, whether the EBITDA margin can be improved due to tighter cost control, any automation improvements or tech innovation factors?

- Also don't forget to compare your EBITDA margin with peers and competitors as well! This is extremely important since you have to give the reader and judges whether the firm's EBITDA margin is performing well against peers and competitors? If so, state in facts and diagrams how much expected % it will continue to grow in upcoming next 3-5 years. This will also impact on the Valuation!

- Moreover, you might need to consider expenses of your target firm, that includes both fixed and variable operating expenses. In terms of financial analysis, are your firm's inventory capital tied-up too much or not much stocks in the warehouse. Also state what are the strategic plans and improvements your firm is currently doing to improve those results if they are not satisfied compared with competitors.

- Regarding Liquidity and Solvency factors, this is also important in this Financial Analysis section. You, as a financial analyst need to state whether your company is too leveraged or de-leveraged. If it is leveraged, what is the current D/E ratio, and state what will be the expected D/E ratios in upcoming future.

- Also state, the Net Working Capital (NWC) of your firm regarding with the Cash flows. Negative NWC are not usually preferred unless strong objections could be made such as major business expansion, or improvements. The Research Report must be stated clearly such that readers and judges can understand your statements and objections.

- Other important factors you should state in this Financial Analysis Section includes ROIC (Return on Invested Capital), Cashflows (projected), Cash to cash conversion (in terms of account receivables, account payables, days in inventory, and operating cycle) etc. For details, you might need to checkout my sample research report later. Now, let's get to the next step!

3. Valuation Techniques

This is the very important step in equity research valuation. There are many and variety of ways we could evaluate on the target equity firm.

However, in our case, we decide to use a mix valuation model of:

- 50% weighted in Discounted Cash Flow (DCF) model

- 30% weighted in 2-stage Dividend Discount Model (DDM) model

- 20% weighted in P/E/G Multiples Valuation Model.

Let's explore one by one on these valuation model as follows:

Discounted Cash Flow (DCF) Valuation Model

The DCF model is used to estimate the value of an investment based on its expected future cash flows. The basic idea is to project the future cash flows and then discount them back to the present value using a discount rate.

Where:

( CF_t ) = Cash flow at time ( t )

( r ) = Discount rate

( n ) = Number of periods

Here are some of the general steps on how to apply the DCF valuation model as follows:

Step 1: Forecast the expected cash flows for a certain period.

Step 2: Determine the discount rate (often the weighted average cost of capital, WACC).

Step 3: Calculate the present value of each future cash flow.

Step 4: Sum the present values to get the total DCF.

Example: Imagine you’re evaluating a tech startup expected to generate the following cash flows over the next five years:

- Year 1: $100,000

- Year 2: $150,000

- Year 3: $200,000

- Year 4: $250,000

- Year 5: $300,000

Assume the discount rate (WACC) is 10%.

Calculation:

Real-World Applications of DCF valuation model

As a professional research financial analyst, we need to keep in mind that DCF valuation model is very idea in this following areas:

- Tech Startups: Investors often use DCF to value tech startups by projecting future cash flows based on user growth, market share, and potential revenue streams. For example, a venture capitalist might use DCF to decide whether to invest in a new AI company by estimating its future cash flows and discounting them to present value.

- Mergers and Acquisitions: Companies use DCF to evaluate potential acquisition targets. For instance, when a large corporation considers acquiring a smaller competitor, it uses DCF to estimate the target’s intrinsic value and determine a fair purchase price.

- Infrastructure Projects: Governments and private firms use DCF to assess the viability of large infrastructure projects like highways, bridges, or power plants by forecasting future cash flows from tolls or energy sales.

Limitations of DCF valuation model

However, not every valuation model is perfect to do so. Here are some limitations we have known so far when applying the DCF valuation model.

- Forecasting Accuracy: The model’s reliability depends on accurate cash flow projections, which can be challenging for volatile industries.

- Discount Rate: Selecting an appropriate discount rate is subjective and can significantly impact the valuation.

- Long-Term Projections: Estimating cash flows far into the future involves considerable uncertainty.

2-Stage Dividend Discount Model (DDM)

The two-stage DDM is used to value a company that is expected to have two distinct growth phases: an initial high-growth phase followed by a stable growth phase.

Where:

( P_0 ) = Present value of the stock

( D_t ) = Dividend at time ( t )

( r ) = Discount rate

( g ) = Growth rate in the stable phase

( n ) = Number of periods in the high-growth phase

If you have a chance to use this 2-stage DDM model, here are some of the steps that you may want to note it as follows:

Step 1: Estimate dividends during the high-growth phase.

Step 2: Discount these dividends to their present value.

Step 3: Estimate the terminal value at the end of the high-growth phase using the Gordon Growth Model.

Step 4: Discount the terminal value to its present value.

Step 5: Sum the present values of the dividends and the terminal value.

Example: Consider a company expected to pay dividends of $2 per share for the next three years, growing at 15% annually. After three years, the growth rate is expected to stabilize at 5%. The discount rate is 10%.

Calculation:

Step 1: Calculate High-Growth Phase:

D2=2.30×(1+0.15)=2.645

D3=2.645×(1+0.15)=3.04175

Step 2: Calculate Stable-Growth Phase:

Step 3: Calculate Present Value:

Real-World Applications of 2-Stage Dividend Discount Model (DDM)

- High-Growth Companies: The two-stage DDM is ideal for valuing companies in high-growth industries like biotechnology or renewable energy. For example, an investor might use this model to value a biotech firm expected to have high growth due to new drug approvals, followed by stable growth as the market matures.

- Transitioning Firms: Companies transitioning from rapid growth to stable growth, such as a tech firm moving from an expansion phase to a mature phase, can be valued using this model. This helps investors understand the company’s value during different growth stages.

Limitations of 2-Stage Dividend Discount Model (DDM)

- Dividend Dependency: Only applicable to companies that pay dividends.

- Growth Rate Estimation: Accurately estimating future growth rates can be difficult.

- Discount Rate: Similar to DCF, choosing the correct discount rate is subjective.

P/E/G Multiples Valuation Model

The PEG ratio is used to determine a stock’s value while taking the company’s earnings growth into account. It is a refinement of the P/E ratio that considers the growth rate of earnings

Where:

( P/E ) = Price-to-Earnings ratio

( g ) = Earnings growth rate (expressed as a percentage)

Here are some of the steps for P/E/G multiples valuation model.

Step 1: Calculate the P/E ratio by dividing the current stock price by the earnings per share (EPS).

Step 2: Determine the earnings growth rate.

Step 3: Divide the P/E ratio by the growth rate to get the PEG ratio.

A PEG ratio of 1 is considered fair value, less than 1 is undervalued, and greater than 1 is overvalued.

Example: Suppose a company has a P/E ratio of 20 and an expected annual earnings growth rate of 10%.

Calculation:

Interpretation: A PEG ratio of 2 suggests the stock might be overvalued, as a PEG ratio of 1 is considered fair value.

Real-World Applications of P/E/G Multiples Valuation Model

- Growth Stocks: Investors use the PEG ratio to evaluate growth stocks, such as tech giants like Amazon or Google. By comparing the PEG ratios of these companies, investors can determine which stocks are undervalued relative to their growth rates.

- Industry Comparisons: The PEG ratio is useful for comparing companies within the same industry. For instance, an investor might compare the PEG ratios of different pharmaceutical companies to identify the best investment opportunities.

Limitations of P/E/G Multiples Valuation Model

- Growth Rate Accuracy: The model relies on accurate growth rate projections, which can be challenging to estimate.

- Earnings Volatility: Companies with volatile earnings may have misleading PEG ratios.

- Industry Differences: PEG ratios can vary significantly across different industries, making comparisons challenging.

4. Understanding The Importance Of ESG Factors

In today’s investment landscape, Environmental, Social, and Corporate Governance (ESG) factors have become crucial in evaluating and valuing equity stocks. Investors increasingly recognize that companies excelling in ESG metrics are likely to outperform over the long term. This blog explores why ESG factors are essential in stock valuation and how they influence buy or sell decisions.

Now, let's explore about what is ESG actually?

Actually, ESG stands for Environmental, Social and Corporate Governance factors, with a detailed definition as follows:

- Environmental Factors: These include a company’s impact on the environment, such as carbon emissions, waste management, and resource usage. Companies with strong environmental practices are often seen as less risky and more sustainable in the long run.

- Social Factors: These encompass a company’s relationships with employees, suppliers, customers, and communities. Issues like labor practices, diversity, and community engagement fall under this category.

- Corporate Governance Factors: These involve the company’s leadership, executive pay, audits, internal controls, and shareholder rights. Good governance ensures transparency, accountability, and ethical business practices.

Real-World Applications of ESG factors in equity stock valuation!

-

Risk Mitigation: ESG factors help identify potential risks that traditional financial analysis might overlook. For example, a company with poor environmental practices might face regulatory fines or reputational damage, impacting its financial performance.

- Example: The BP oil spill in 2010 led to significant financial losses due to fines, cleanup costs, and reputational damage. Investors who considered BP’s environmental risks might have avoided substantial losses.

-

Long-Term Performance: Companies with strong ESG practices often demonstrate better long-term performance. They tend to be more resilient and adaptable to changing market conditions.

-

Regulatory Compliance: Companies adhering to ESG standards are better prepared for regulatory changes. This compliance reduces the risk of legal issues and associated costs.

-

Consumer Preferences: Increasingly, consumers prefer brands that align with their values. Companies with strong ESG practices can attract and retain customers, driving revenue growth.

Integrating ESG into Investment Decisions

- Adjusting Discount Rates: Investors can adjust discount rates in valuation models to account for ESG risks. Companies with poor ESG scores might warrant higher discount rates, reflecting higher risk.

- Modifying Cash Flows: Future cash flows can be adjusted to reflect the impact of ESG factors. For instance, companies with strong ESG practices might have lower operational risks and more stable cash flows.

- Using ESG Scores: Many rating agencies provide ESG scores that investors can use to compare companies. These scores offer a quick snapshot of a company’s ESG performance.

Limitations of ESG in Stock Valuation

- Data Availability and Quality: ESG data can be inconsistent and difficult to compare across companies. The lack of standardized reporting makes it challenging to assess ESG performance accurately5.

- Subjectivity: Evaluating ESG factors involves a degree of subjectivity. Different investors might prioritize different aspects of ESG, leading to varying conclusions6.

- Short-Term Focus: Some investors may focus on short-term gains, overlooking the long-term benefits of strong ESG practices.

- Double Counting: Adjusting financial models for ESG factors can sometimes lead to double counting risks already reflected in market prices.

For now, as for the CFA equity research report, we believed that ESG factors are very useful and critical in modern equity valuation. This is because we can know a comprehensive view of a company’s risks and opportunities, helping investors make informed buy or sell decisions. While there are challenges in integrating ESG into investment analysis, the benefits of considering these factors far outweigh the limitations.

5. Reporting Writing Technqiues

Writing an equity research report for the CFA Research Challenge requires a blend of analytical rigor, clear communication, and strategic presentation. Here are some detailed techniques you should follow to get the winning equity research report:

1. Structure and Organization

Executive Summary:

- Concise Overview: Summarize the key findings, investment thesis, and recommendation (buy, hold, or sell).

- Key Metrics: Include target price, current price, and potential upside/downside.

Company Overview:

- Business Description: Provide a detailed description of the company, its products/services, and market position.

- Financial Summary: Highlight key financial metrics such as revenue, EBITDA, net income, and margins.

Industry Analysis:

- Market Dynamics: Discuss industry trends, growth drivers, and challenges.

- Competitive Positioning: Use frameworks like Porter’s Five Forces to analyze the competitive landscape.

Investment Thesis:

- Core Arguments: Present the main reasons for your investment recommendation.

- Supporting Evidence: Use data and analysis to back up your thesis.

Valuation:

- Valuation Methods: Explain the valuation models used (DCF, DDM, multiples, etc.).

- Assumptions: Clearly state the assumptions behind your models.

- Sensitivity Analysis: Show how changes in key assumptions impact the valuation.

Financial Analysis:

- Historical Performance: Analyze past financial performance and trends.

- Forecasts: Provide detailed financial projections for the next few years.

Risks:

- Risk Factors: Identify and discuss the main risks to your investment thesis.

- Mitigation Strategies: Suggest ways to mitigate these risks.

Conclusion:

- Final Recommendation: Reiterate your investment recommendation and summarize the key points.

2. Writing Techniques

Clarity and Precision:

- Be Clear: Avoid jargon and complex sentences. Aim for clarity and simplicity.

- Be Precise: Use specific data and examples to support your points.

Logical Flow:

- Coherent Structure: Ensure each section logically follows the previous one.

- Smooth Transitions: Use transitional phrases to guide the reader through your report.

Visual Aids:

- Charts and Graphs: Use visual aids to illustrate key points and make data more digestible.

- Tables: Summarize financial data and projections in tables for easy reference.

Consistency:

- Formatting: Maintain consistent formatting throughout the report.

- Terminology: Use consistent terminology and definitions.

3. Valuation Techniques

DCF Model:

- Detailed Projections: Provide detailed cash flow projections and justify your assumptions.

- Discount Rate: Explain how you determined the discount rate (WACC).

Two-Stage DDM:

- Growth Phases: Clearly differentiate between the high-growth and stable-growth phases.

- Terminal Value: Justify the terminal growth rate used in your calculations.

Multiples Valuation:

- Comparable Companies: Select appropriate peer companies for comparison.

- Multiples Selection: Justify the choice of multiples (P/E, EV/EBITDA, etc.).

4. Common Pitfalls to Avoid

Over-Reliance on One Model:

- Diversify Valuation Methods: Use multiple valuation models to cross-verify your results.

Ignoring Risks:

- Comprehensive Risk Analysis: Address all potential risks and their impact on your valuation.

Lack of Supporting Evidence:

- Data-Driven Analysis: Back up your claims with data and thorough analysis.

5. Presentation Tips

Engaging Delivery:

- Practice: Rehearse your presentation multiple times to ensure smooth delivery.

- Engage the Audience: Make eye contact, use gestures, and vary your tone to keep the audience engaged.

Q&A Preparation:

- Anticipate Questions: Prepare for potential questions and practice your responses.

- Stay Calm: Remain composed and confident during the Q&A session.

6. Understanding The Rules Of CFA Research Challenge!

Finally, you should also know about the rules of the game as well. Here are some key rules as follows:

1. Team Composition

- Team Size: Each team must consist of 3-5 members who are full-time undergraduate or graduate students.

- Eligibility: Team members must be enrolled in the same university and cannot have previously participated in the CFA Research Challenge.

2. Research and Analysis

- Original Research: Teams must conduct their own research and analysis. Plagiarism or using third-party research without proper attribution is strictly prohibited1.

- Interaction with Subject Company: Teams are allowed to interact with the subject company but must adhere to guidelines regarding the type and extent of interaction.

3. Written Reports

- Report Length: The written report must not exceed 10 pages, excluding the appendix1.

- Content Requirements: The report should include an executive summary, business description, industry overview, investment summary, valuation, financial analysis, and risk analysis.

4. Presentations

- Presentation Format: Teams must present their findings to a panel of judges. The presentation should be professional and well-structured1.

- Q&A Session: After the presentation, teams will participate in a Q&A session with the judges to defend their analysis and conclusions.

5. Faculty Advisor and Industry Mentor

- Role of Advisors: Each team is assigned a faculty advisor and an industry mentor. The faculty advisor provides guidance on research methods, while the industry mentor offers practical insights1.

- Time Limits: There are specific time limits on how much time teams can spend with their faculty advisor and industry mentor to ensure fairness.

6. Ethics and Professional Conduct

- Code of Ethics: Participants must adhere to the CFA Institute Code of Ethics and Standards of Professional Conduct.

- Conflicts of Interest: Teams must disclose any potential conflicts of interest and avoid actions that could compromise the integrity of the competition.

7. Competition Levels

- Local, Regional, and Global: The competition has three levels: local, regional, and global. Winning teams at each level advance to the next stage, culminating in the global final.

7. Don't Underestimate The Cooperation As A Team!

Finally, I want to state that the cooperation and teamwork is very important for such competitive challenges. So, don't underestimate the impact of teamwork, since it will also be an important factor whether your competition as a team will goes to the next round or not!

CONCLUSION

To summarize, I would like to give a huge thanks to my audience, for reading up this blog post! However, if you would like to know more about Financial Analysis, Equity Research, and learning more about Finance, you can visit my Udemy courses web page as follows:

Anyway, Thank you!!., stay safe, and we will see back again!!.

Mr. Thu Ta Naing (MBA, CFA-Research Semi-Finalist 2024)